Monday, August 23, 2010

Value Businesses Expanding in Florida

McDonalds, Dollar Tree, discount grocery store, Aldi, and other "value" businesses are among the few businesses expanding in Florida. This is attributed to the slow economic recovery of Florida, paired with consumers trying to find the best deals. McDonalds plans to build and renovate 20 stores this year and Dollar Tree plans to open 5-10 stores in South Florida this year. With the recession in full swing, "value" is where the Florida economy is finding expansion.

Wednesday, August 18, 2010

5 Tips for Managing Your Finances

Managing your finances in recessionary times can be difficult, but it is also essential for keeping a balanced budget.

Here are 5 tips for managing your finances:

Here are 5 tips for managing your finances:

- Make a list of your expenses and income - You have to know if you are taking in more than you are spending.

- Identify budget allocations which can be eliminated or reduced - Consider cutting budget allocations for dining out or trips to the spa.

- Keep an eye on your credit cards - Be sure to make monthly payments on credit cards and do not use them to forgo debts.

- Enjoy simple pleasures - Reward yourself by doing inexpensive things such as going to the beach or going to the park, or get together at a friend's house instead of going out to a bar.

- Save - As much as you can, even if it's only loose change or a couple dollars a day.

Sunday, August 15, 2010

How to Buy Foreclosed Homes

In this video, Vera Gibbons discusses how to buy foreclosed homes in today's buyers market. Florida home prices are down 30% from the peak in 2006 and the amount of foreclosures have made this a buyers market.

Labels:

buyers market,

foreclosed homes,

foreclosures,

vera gibbons,

video

Tuesday, August 10, 2010

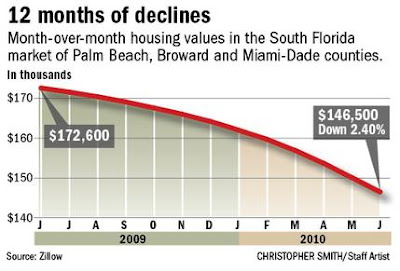

South Florida Home Values Drop From 2009

South Florida home values dropped further than 25 other metropolitan areas in Q2 of this year, falling 15% since 2009

South Florida home values dropped further than 25 other metropolitan areas in Q2 of this year, falling 15% since 2009Median home values in Miami-Dade, Broward and Palm Beach County are now priced at $146,500, down 7% from the beginning of 2010 and 52% from 2006's peak values.

With real estate values still on the decline, it comes as no surprise that 44% of South Florida homeowners' mortgages are "underwater," meaning they owe more on their loan than the house is currently worth.

Subscribe to:

Posts (Atom)